Human Capital Management and the influence of a firm’s talent management performance is changing. It is estimated that a company’s intangible assets, which include human capital and culture, makes up more than 50% of a company’s market value.

And in 2020 and beyond, the talent paradigm is undergoing a massive transformation. Millennials and Gen Z are reshaping corporate culture and how we perceive the nature of work is rapidly evolving. Digital transformation, mobility and remote working constructs are reshaping the workforce and businesses are redefining long-term value and their corporate visions through a new lens.

As a part of this transformation, Boards and C-Suites have placed talent and culture at the vanguard of thinking around the enablement of strategy, innovation and long-term value creation. As a result, Human Capital has rapidly emerged as a critical focus area for leaders in all disciplines. There is clear and growing market appetite to understand how companies are managing and measuring human capital.

On August 26, 2020, the Securities and Exchange Commission (SEC) announced the modernization of Regulation S-K disclosure. These amendments that add human capital resources as a separate disclosure topic, including any human capital measures or objectives that issuers focus on in managing their business. This came about as a result of evolving expectations from investors and other stakeholders calling for changes to disclosures, practices, and governance on a wide range of human capital factors.

These rules changes are extremely current given the COVID-19 pandemic and how it has elevated stakeholder attention on human capital concerns around work-from-home and office constructs, labor instability and employee safety and welfare. Companies are grappling with how to adapt to retain their workforce, provide a safe workplace and respond to difficulties in supply chains or remote work environments. Investors are demanding broader reporting and transparency on HCM.

Up until Q4 of this year, the SEC’s regulations on disclosure related to HCM was limited to Board members and very generalized metrics across the employee base.

With the final amendments to Item 101(c) the SEC has expanded the past requirement to disclose the number of employees with an additional new requirement to provide information regarding the public company’s “human capital resources,” including in such description any human capital measures or objectives that management focuses on in managing its business, to the extent such disclosures would be material to an understanding of the company’s business as a whole. The rule provides a non-exclusive list of examples of human capital measures and objectives that may be material, depending on the nature of the company’s business and workforce, including measures or objectives that address the attraction, development, and retention of personnel. Consistent with other disclosure obligations, materiality of any individual factors will still be determined by the disclosing company.

Investors and stakeholders view HCM and D+I policies and practices as a way for companies to mitigate risks in the short term and create stability and growth in the long term. Industries, Boards, CHRO’s and Investors have recognized that talent strategy is critical for the long-term value of public companies.

HCM and Inclusion require strategy to maximize the productivity of the firm’s talent base.. Companies taking a holistic view of their business strategy on human resources and D+I topics can take advantage of the opportunities to avoid possible risks and connect with large institutional investors who are increasingly interested in these topics as part of wholistic view of the firm.

The vast majority of publicly traded companies have established metrics for HCM as well as Diversity & Inclusion. Despite this, many are not fully prepared to meet the SEC’s new rules.

The following are recommended general considerations for Q4, 2020 disclosures:

Define HCM metrics to be tracked and how they will demonstrate the overall health of the company’s human capital.

Plan how such data will be used to accurately illustrate outcomes of of hiring, promotion, compensation, and attrition trends, or in comparisons within the company by region, segment, or division

Ensure that HCM disclosures and metrics are reported with the same rigor and quality as the company’s other SEC disclosures.

Consider risk mitigation in that any misrepresentations or misleading disclosure, whether in SEC filings or other communications, increases liability.

Verify that any metrics being used internally or disclosed externally is reliable and comparable over time

We have partnered with David Simmonds, Chairman of HCM Metrics and the HR Analytics Group.

HCM Metrics is recognized as the leading global expert on HCM reporting regulations and standards.

David is the first accredited Lead Auditor for ISO 30414:2018 Human Capital Reporting in the world. It is the first International Standard that allows an organization to get a clear view of the ROI of its human capital.

Read more about David and HCM Metrics here.

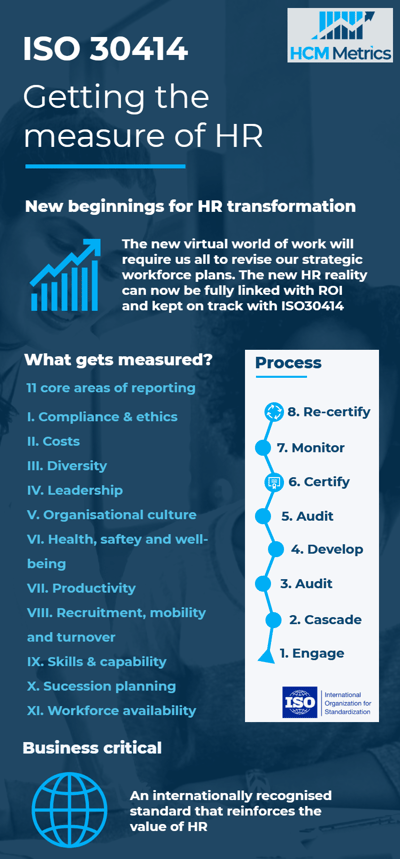

It is anticipated that, over the long-term, the SEC will require the ISO standard, or very similar metrics for Human Capital reporting based on how similar regulatory mandates have evolved in other countries such as the UK and EU. The companies that adopt these first will set the leading standards for the US.

The Guiding Principles of ISO 30414:2018 support the delivery of evidence-based measures. This means an organization has insights that lead to better decision making. Having standard measures across the same sectors means it is easier to compare organizations and provide valuable insights for stakeholders. The important aspects of an organization are identified and provide consistency and ease of understanding. Board members and stakeholders have clarity and transparency in order to govern the business correctly.

An organization must bring focus to Human Capital Management metrics as part of its strategy. The alignment to the ISO standard needs to be pragmatic It must implemented within the organization's operation model. The organization should undertake a cost/benefit analysis. The ISO standard are relevant to all businesses of all sizes across multiple industries.

CRI has developed and are making available to our Clients, a detailed report to provide metrics on external relocations as part of talent recruitment and internal relocations of talent (by policy group).

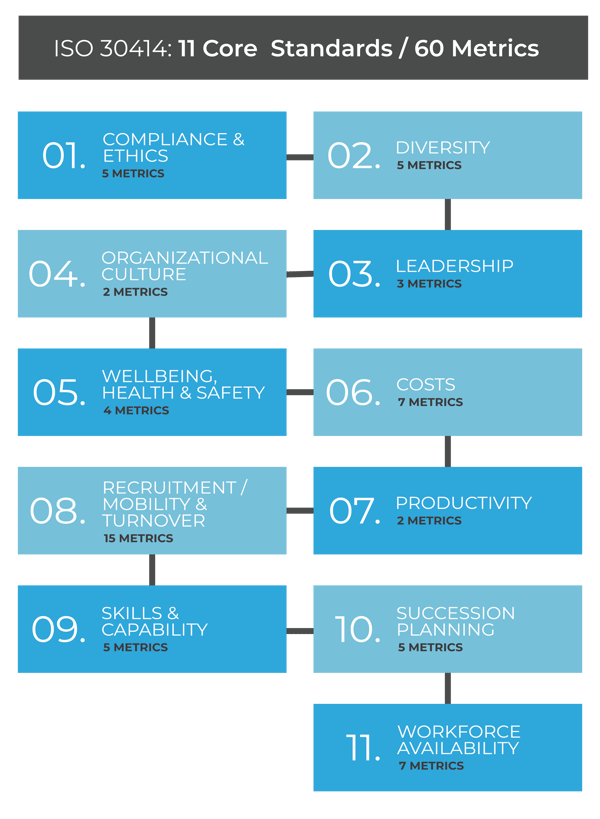

To facilitate a common understanding of reporting requirements, the standard clearly delineates 11 Core Areas of Reporting.

As Q4, 2020 started, many firms found themselves scrambling to define a strategy and reporting structure for this year’s requirement. It is anticipated that firms will report on a variety of metrics until standardization is finalized in the coming reporting periods. The 11 Core Areas can provide a solid foundation to get ahead of the curve for many companies.

Watch CRI’s exclusive interview with David on What Comes Next:

We believe that mobility is a critical element of HCM Reporting.

Slow-moving or ineffective recruitment can be a bottleneck to growth. Cumbersome processes and overstretched teams or unrealistic expectations can make the job of filling vacancies longer and more costly. Poor candidate experience leads to a negative effect on employer brand. Timely and successful recruitment delivers many benefits to your company’s performance. Effective recruitment leaves you well-placed to take advantage of new organizational opportunities. Streamlined, efficient recruitment processes deliver higher-quality, more engaged people, providing a competitive advantage that directly impacts on the bottom line. Poor or slow recruitment can increase attrition rates, with the risk of stress and disengagement within the workforce. It can lead to high turnover resulting in lower productivity and poor morale.

As a result, we have developed and are making available to our Clients, a detailed report to provide metrics on external relocations as part of talent recruitment and internal relocations of talent (by policy group).

The bottom-line is, mobility and relocation impact recruitment and retention dramatically. Poor mobility results in stagnation and poor performance.

The new SEC mandate for Human Capital reporting is a welcome expansion that demonstrates that critical nature of HCM in the minds of stakeholders and investors. These measures not only provide insight into the ROI of human capital investment, but the eventual adoption of ISO standards also gives a globally recognized assurance on people excellence for any organization.

CRI is a privately held organization providing global mobility services for over 30 years. We are a full service international relocation company.